Business Scope

Shipping agency services

1

Shipping transportation

2

Wholesale of ship and component parts

3

Retail sale of ship and component parts

4

All business that are not prohibited or restricted by law, except those subject to special approval

5

Revenue distribution

(consolidated revenue distribution in 2021 and 2022) Unit: %

| Business Activities | 2021 | 2022 |

|---|---|---|

| Rental Revenue | 97% | 96% |

| Cargo Revenue | 0% | 0% |

| Service Revenues | 0% | 0% |

| Other Operating Revenues | 3% | 4% |

| Total | 100% | 100% |

Main Services

As of Dec. 2025, the Company runs a fleet of 24 vessels including 1 passenger ship. Please refer to Fleet Introduction page. At present, We are also continuing to evaluate the plan to purchase energy-saving new-building ships.

Business Model

Bulk shipping refers to the shipping service of carrying bulk cargoes, including daily necessities and basic industrial materials, such as grains, steel products, coal, ores, etc. The schedules and routes depend on the places of delivery, and the lessees determine the routes and ports of call. The cargo shipping is characterized by one-way transportation and being seasonal, and it is a perfectly competitive market. Due to the high uncertainty of the routes, the schedules for supply and repair inspection arrangements also depend on the port information.

New services development

The Company operates the fleet on short or long term time charters trading in compliance with the international trading regulations and is able to provide services for any new route with reasonable remuneration.

Industry Overview

Current Status and Future Development of the Industry

In the face of labor shortages, the factors of crisis of supply chain interruptions, the global logistics restrictions and trade tensions, border closure and port congestion, lack of international shipment and the difficulty for crews to swap shifts all challenged the flexibility and resilience of the shipping operators. To rebuild the resilience of the supply chain, remove the obstacles for sea crews to ship swap, increase turnover rate of ships, tackle the difficulties, and make rolling adjustment of strategies at any time are the ways to go through the hard time. The loose monetary policies adopted by countries and the promotion of infrastructure construction in 2020 stimulated global economic growth in 2021. The prices of bulk commodities rose, the international crude oil prices remained high, and the hire rates of the fleet soared, which all contributed to explosive growth of bulk shipping.

The BDI index hit the lowest at 1,296 points (January 26, 2022) and the highest at 5,650 points (October 7, 2021) between 2021 and 22Q1. The index increased significantly in 21Q1. The average BDI index in 2021 increased by times compared with that in 2020. The BDI index fell in the beginning of 2022, and the downward trend continued until the Lunar New Year holiday. However, after that, the index rebounded and the BDI averaged 2,041 points in 23Q1. Yet the upward trend was hindered by Russo-Ukrainian War, disrupting what was expected in the market. In 2022, we paid close attention to the trend of the BDI Index and the fluctuation of the dry bulk market in the trouble times.

In terms of the market demands, bulk shipping is dominated by bulk commodities such as iron ore, coal, and grains, mainly finished and semi-finished products. Market demands are closely related to the global trade volume of bulk commodities. Russia and Ukraine are the major exporting countries of energy, grains, and industrial metal, which account for 2% of the global trade volume. From the perspective of macroeconomy, The IMF forecasted 3.1% global economic growth for 2024 in its latest World Economic Outlook report (January), an increase of 0.2% compared with that for 2023.

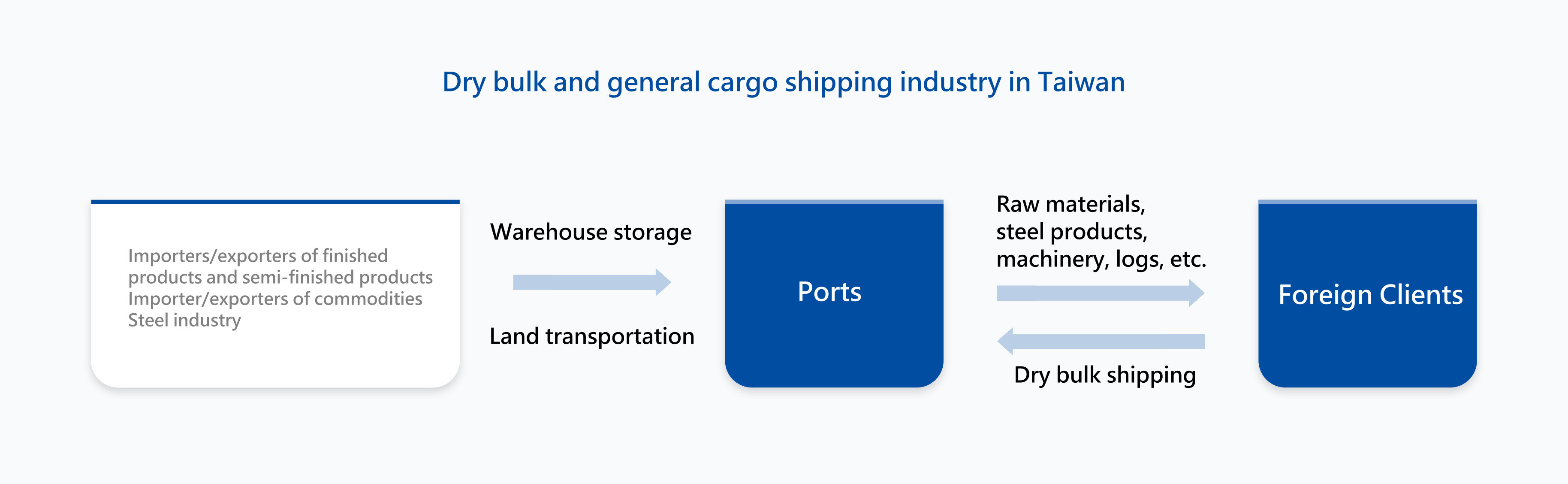

Relationship with Up-, Middle- and Downstream Companies

The maritime shipping industry is a part of the transportation service industry and mainly provides maritime shipping services for cargo. It is different from the general manufacturing industry and does not involve production of goods or supply of raw materials. There is no clear presence of up-, middle- and downstream relationships in the industry.

Overview of Industry Trend

Currently, the world shipping regulations are mainly characterized by measures for reducing environmental hazards caused by the emissions of vessels. The measures include the calculations of carbon footprint of ships, the use of low-sulfur fuel to reduce sulfur oxide emissions, the installation of the ballast water management system to reduce water pollution and building future eco-friendly ships that emit less nitrogen oxide or are powered by liquefied natural gas or Biofuel instead of fossil fuels.

Shipbuilders will focus on building energy efficient and eco-friendly vessels. To comply with international regulatory requirements, shipbuilders set sales target to build new types of vessels that do not cause environmental pollution.

Following this industry trend, the fleet development for the future will move toward young fleets with eco-friendliness and fuel efficiency.

Competition in the Industry

The keen competition in the global shipping market and the implementation of international regulations for environmental protection forced the shipping companies to invest in the modification of vessels in operation, strengthen management, retrofit equipment when required, and pursue economies of scale for cost reduction. We work with high-quality shipyards to build energy-efficient and eco-friendly vessels to maintain a highly competitive fleet.

Take specific actions and implement ESG policies from every little thing at work and in the daily life.

We are continuously review and improve our environmental, social and governance rights and responsibilities, fulfill the corporate social responsibility, and step toward sustainable corporate development with kindness.

Learn more